A Red Flag Warning remains in effect for most of the region 10am-9pm today. Gusty northerly winds will combine with very dry air to result in critical fire danger. Please remember:

-Observe the countywide burn ban.

- Avoid welding outside and other activities that can cause sparks.

- Make sure tow chains are not dragging behind your vehicle. That can cause sparks.

- Don’t idle vehicles on the grass.

- Don’t flick cigarette butts out the window

The elevator at the Caldwell County Courthouse will be out of order on Thursday, February 19 for maintenance. We will let the public know when maintenance is complete and it is back online.

While the area is not under any watches or warnings at this time, please pay attention to weather reports and forecasts as we move toward early afternoon.

A level 1 of 5 risk for strong to severe storms is forecast for most of South-Central Texas today, including Caldwell County. The greatest potential for storms will be this afternoon and evening. Damaging wind, large hail, and lightning are possible. Stay weather aware if you have outdoor plans. Have multiple ways to receive weather warnings, including enabling WEA alerts in your smartphone or making sure you're signed up to receive updates from warncentraltexas.org.

From the National Weather Service: Light rain showers will persist through the morning before a broken line of isolated thunderstorms advances from west-northwest to east-southeast across the region. The main window for storms will be 10 AM to 2 PM for the Hill Country and Southern Edwards Plateau, 1 PM to 5 PM for the I-35 corridor (including Austin and San Antonio), and 4 PM to 8 PM for the Coastal Plains. Some storms may become strong to severe, capable of producing gusty straight-line winds and hail.

Caldwell County Commissioners discussed the burn ban, Black History Month and approved a flurry of grant applications at their Feb. 12, 2026 regular meeting.

Black History Month, Black leadership highlighted with trio of proclamations

Caldwell County commissioners approved three proclamations recognizing the important contributions of Black Americans to our community.

-

- Black History Month: All residents are encouraged to observe this month by participating in educational programs, community events, and acts of reflection and service that celebrate African American history, honor its lasting impact and promote unity, tolerance and acceptance of one's own neighbor throughout Caldwell County. Read the full proclamation.

- Caldwell County Progressive Club: In 1974, four Black construction workers - Ammie Carter Jr., Hiawatha Franks Sr., Nathaniel "Bubba" Bennett Jr., and Homer Williams Sr. learned that there were disparities in the opportunities to collegiate scholarship for African American students graduating from Lockhart High School. To fix this scholarship challenge, a nonprofit, The Caldwell County Progressive Club was organized as a nonprofit. The Progressive Club provides five scholarships to Lockhart High School graduates who apply and meet all the qualifications of the scholarship criteria. Read the full proclamation.

- Vessie Davis Tutt Day: Commissioners approved a proclamation celebrating the 100th birthday of Vessie Davis Tutt. Ms. Tutt, who was born in St. John Colony in 1926, is a direct descendant of Andrew and Laura Davis, among the original trailblazers who settled St. John Colony in Caldwell County in 1870. The proclamation recognizes her as a respected example of resilience, perseverance, and inspiration within her community. Read the full proclamation.

Caldwell County Commissioners presented Pastor Lora Hardaway with a proclamation recognizing February as Black History Month. Pictured (l-r) are: Pct. 1 Commissioner BJ Westmoreland, Pct. 2 Commissioner Rusty Horne, Pastor Lora Hardaway, County Judge Hoppy Haden, Judge Pro-Tem Ed Theriot and Pct. 4 Commissioner Dyral Thomas.

Burn Ban extended amid persisting drought conditions

Commissioners voted to extend the burn ban another two weeks amid persistent dry conditions. The Caldwell County Office of Emergency Management recommended the countywide burn ban extension, citing that the Texas Forest Service had noted that Travis, Lee, Caldwell and Hays counties remain in a drought. All outdoor burning is prohibited at this time. If you must burn, please contact the appropriate offices to apply for a special permit. Information about that can be found on the Emergency Management webpage.

Flurry of grant applications approved

Commissioners approved resolutions authorizing applications for three grants aimed at making sure county law enforcement and first responders have necessary tools while out protecting residents of Caldwell County.

-

- A grant application to the Office of the Governor’s Public Safety Office (PSO) for the FY 2027 Body-Worn Camera Program. Body-worn cameras record video and audio of police interactions with the public. They provide objective evidence for investigations and court proceedings, improve report accuracy, and can deter aggressive behavior from both the public and officers. Grant funding uses would include purchasingadditional equipment and replacing dated equipment.

- An application for funding from the PSO for the FY 2027 Rifle-Resistant Body Armor Program. The county is planning on purchasing 52 vests if awarded the grant.

- An application for funding through the HB 3000 Rural Ambulance Grant Service program for Caldwell County ESD #5. Proceeds can be used for modifying, purchasing or reconstructing ambulances.

This is a brief summary of discussion and action highlights of the Feb. 12, 2026 regular commissioners court meeting. See full agendas and official meeting minutes and watch full video of the meetings.

Caldwell County administrative offices will be closed Monday, Feb. 16 for Presidents Day and will reopen Tuesday, Feb. 17.

The Caldwell County Office of Emergency Management will host the inaugural meeting of the Caldwell County Local Emergency Planning Committee (LEPC) on Tuesday, Feb. 17 at 10:30 a.m. at the Caldwell County Justice Complex training room.

The LEPC is a state and federally mandated group of local officials and chemical industry representatives that educates the public. trains first responders and coordinates resources for effective preparedness and recovery for all hazards.

The meeting is open to the åçpublic. Local officials, first responder leadership, Industry Tier II reporters and other stakeholders in Caldwell County have been invited to participate.

The first meeting will include a presentation by a Texas Division of Emergency Management (TDEM) representative who will discuss the importance of an active LEPC in the county and talk about the hazards of lithium batteries.

We look forward to offering this opportunity for hazardous material education to our local first responders and community.

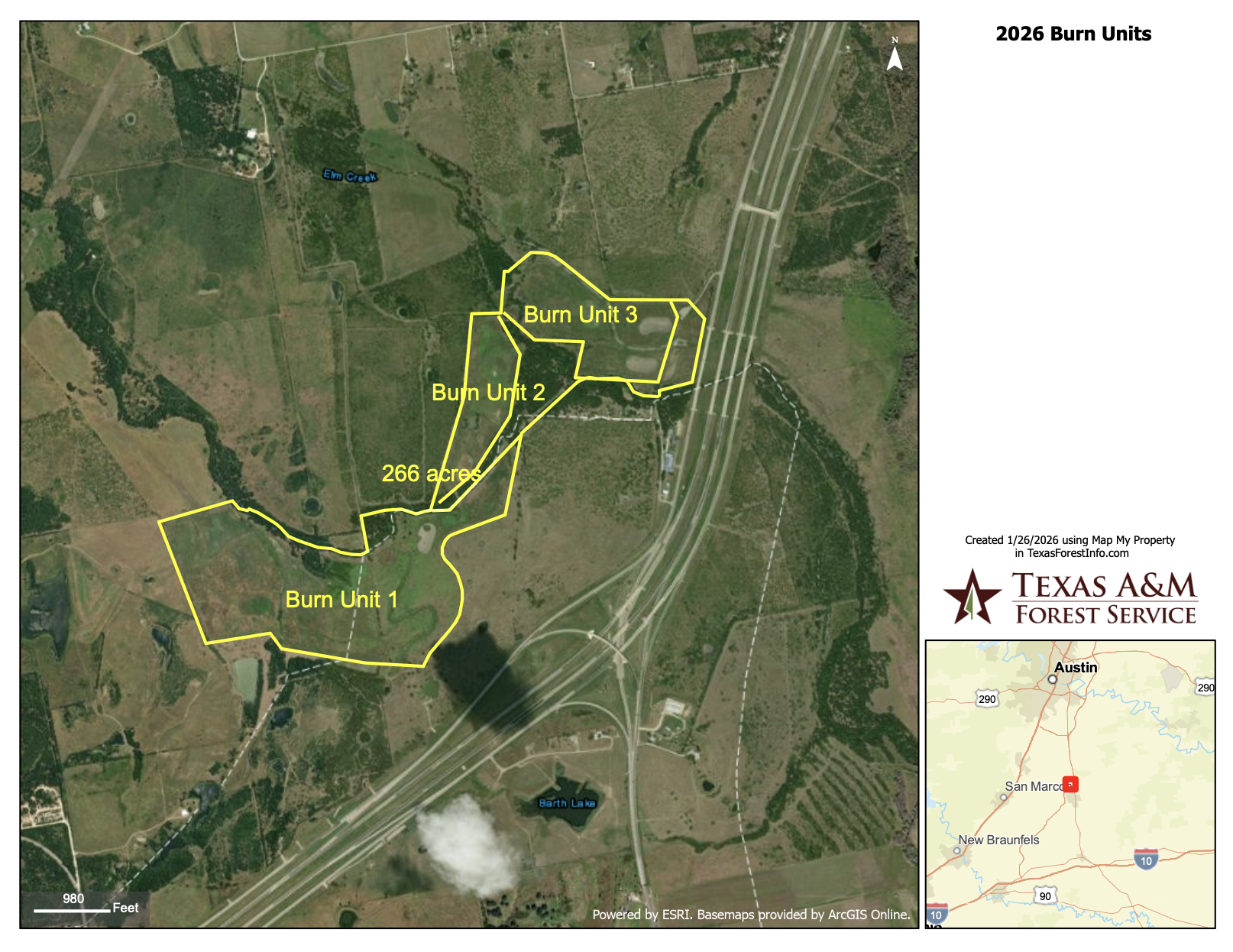

UPDATE (2-11-2026): The burn will now begin at noon on Wednesday, February 11 due to windy conditions. Crews are installing additional fire breaks to make sure the burn stays contained.

---------------------------------------------------------------

The Caldwell County Office of Emergency Management is advising the public that Texas Wildlife Conservation will conduct a prescribed burn for the Plum Creek Conservation Area beginning at 8 a.m. Wednesday, February 11.

The park's exact location is at 3105 North US 183 (SH 130 frontage road), Lockhart, Texas 78644. GPS coordinates are 29’55806424 North / 097”40.622675 West.

Prescribed burns are deliberately ignited, controlled fires used to restore ecosystem health, reduce hazardous fuel loads (like brush and dead wood) to prevent catastrophic wildfires, and manage land by eliminating invasive species. These burns promote new growth, enhance wildlife habitats, and recycle nutrients into the soil.

This burn will involve more than 200 acres. The land has been prepared with fire breaks, or trenches, to contain the fire to the prescribed burn area. Firefighters and representatives of the Texas Forest Service will be present to observe and assist.